Table of Contents

Despite the uncertainty caused by the coronavirus crisis and the process of the UK’s exit from the European Union, service fees in the UK funeral industry are experiencing sustained growth, which translates into a regular increase in income for the industry in an increasingly complex sector, largely due to the cultural and religious differences of an increasingly diverse and global society.

UK funeral industry: main types of funeral services

The funeral sector in Great Britain mainly carries out three types of tasks: administrative tasks associated with the funeral; formalities related to the treatment of the body, its transport, burial or cremation and, finally, the organisation and celebration of the ceremony or service.

Within these functions, the UK funeral industry is very varied due, in large part, to the cultural differences that exist in the country. For this reason, some funeral homes allow their customers to create a plan tailored to the wishes of the deceased, although most of them offer three types of funeral services for a closed rate: standard funeral, simple funeral and direct cremation.

3 types of funeral services

The standard funeral is the most popular option and includes:

- Collection and transport of the deceased: provision of staff and a suitable vehicle to collect the deceased from the place of death and transport to the funeral facilities.

- Storage of the deceased in the mortuary.

- Care of the deceased: washing and dressing the deceased, placing the body in a coffin and recording of personal effects.

- Viewing of the deceased in the chapel of rest.

- Provision of a standard coffin.

- Customer advice and support to assist with celebrating the funeral, as well as legal and administrative services.

- Managing arrangements related to burial, cremation, cemetery, church and any ceremony officiant.

- Organising the payment of third-party disbursements.

- Provision of hearse, limousines and staff.

- Embalming (sometimes).

The simple funeral is more limited and, therefore, has a lower cost. It includes many of the standard funeral elements, but usually excludes the provision of limousines; it has limited or no choice of date and time for the funeral service; it offers no viewing options; and it includes a basic casket with limited or no opportunity for enhancement.

Direct cremation is a service without family assistance or ceremony. All the formalities are usually left to the funeral home, which concludes its work with the delivery of the deceased’s ashes. As an alternative, there is also direct assisted cremation, which includes a small ceremony in which the relatives of the deceased are present.

Growth in the demand for crematoria in the UK funeral industry

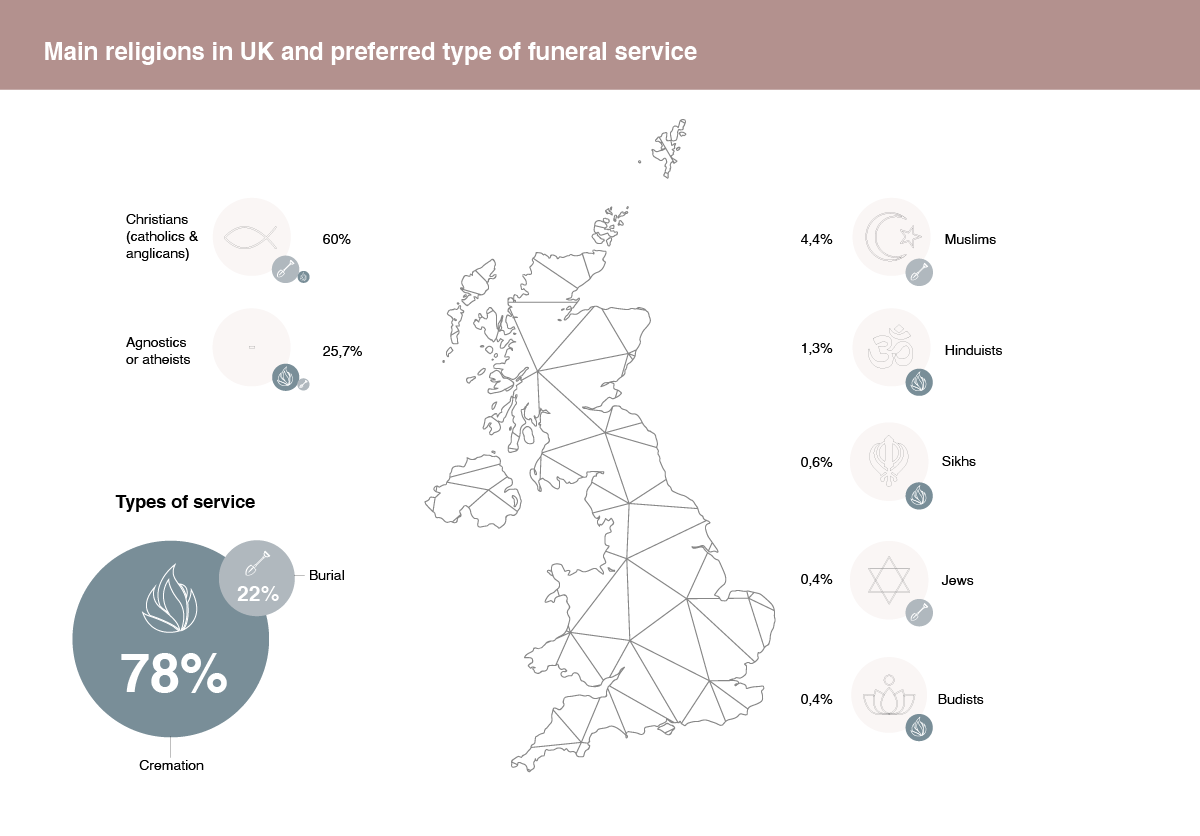

Cremation has become the preferred option for the British to say goodbye to their loved ones. This demand has steadily grown over the last 60 years, from 35% cremations in 1960 to over 78% in 2018. The increase in cremations is mainly due to their low cost, compared to traditional burial, and also to the progressive acceptance of this method by the Catholic and Anglican Church.

As a result of this growing demand, the number of crematoria in the UK funeral industry has also increased. According to British government figures, at the end of 2019 there were 303 crematoria in the country. The development of the cremation industry began in 1930 and reached its peak in the 1960s, driven by the municipal authorities seeking to introduce an alternative to cemeteries. The 1980s saw further growth due, in large part, to the proliferation of private companies.

In 2018, about 480,000 cremations were carried out, 67% of the total in local authority facilities. This predominance of the public sector has declined considerably over the last ten years, with private companies accounting for nearly all of the increase in the demand over the last decade. With regard to the revenues received by cremation service providers, the vast majority come from standard fees.

Service fees in the UK market

According to public sources, the British spent £2 billion on funeral services in 2018, with a total of 616,014 deaths recorded. The average funeral fee is £2,500, with a large difference between the cost of burial, which is around £2,268, and cremation, which is £1,170. Other added services, not included in the basic funeral, such as flowers or catering, cost an average of £2,306.

Funeral rates in the UK market have increased by an average of 4.6% per year over the last 13 years, with 1.7 % of this increase due to inflation. Payments to third parties for cremations have increased by 5.6% (2.5% inflation) while those for burials have risen by 7.4% (4.4% inflation).

Most funerals, 84% in 2018, were ordered and paid at the time of mourning, while 26% opted for a prepaid plan through a trust fund or an insurance company. Prepaid plans increased significantly between 2002 and 2016, but have significantly declined over the last four years.

How the funerals are paid for

| Method of payment | Percentage |

|---|---|

| Money left behind/inherited from the deceased | 34% |

| Personal savings | 21% |

| Personal savings of another family member | 12% |

| Credit card | 10% |

| Credit card of another family member | 6% |

| Cash, cheque or insurance policy from unspecified source | 4% |

| Bank/building society/credit union loan | 3% |

| Bank/building society/credit union loan in name of another family member | 3% |

| Cash (source not specified/unclear) | 2% |

| DWP Funeral Expenses Payment | 1% |

| Cheque (source not specified/unclear) | 1% |

| Insurance policy (source not specified/unclear) | 1% |

| Grant or loan from charity | 1% |

| Crowdfunding | 1% |

| Another way | 4% |

| Prefer not to say/don’t know/can’t remember | 9% |

*Fuente: Market Investigation consumer survey to all UK adults +18 involved in making at-need burial or cremation arrangements since 2018.

Bursting of low-cost services

The last four years have seen a new trend in the UK funeral industry marked by the emergence of low-cost services such as direct cremation and simple funeral. Funeral directors point out that this option, which usually costs between 700 and 1,000 euros, is in greater demand year after year.

Direct cremation provides a simple service without a wake, flowers, room hire or public transfer of the deceased. The procedures only require a phone call and the funeral service companies are responsible for collecting the body, carrying out the cremation and delivering the ashes to the relatives.

According to the British funeral home SunLife Limited, direct cremations accounted for only 4% of total cremations in the UK in 2019. However, many industry experts insist that low-cost options are showing a rapid recent growth. The reason, in addition to customers’ search for affordable rates, is the increased demand for secular and customised funerals at the expense of traditional religious services.

Cultural and religious differences in the UK funeral industry

Cultural and religious diversity are issues that funeral service providers must take into account in an increasingly pluralistic and globalised British market. According to the figures of the National Statistics Office of the United Kingdom, the last census carried out (2011) reveals that almost 60% of the population declare themselves Christians (Catholics and Anglicans), 25.7% are atheists or agnostics, 4.4% are Muslims and 1.3% claim to practice Hinduism followed by other religions such as Sikhism, Judaism and Buddhism.

Types of services in the UK market according to religion

Each religion has its own funeral rites. For example, Hindu and Sikh funerals are almost exclusively cremations, while the Muslim and Jewish religions only allow burial. Catholicism provides a greater degree of freedom but advocates burial as the best choice.

Sometimes these traditions also influence the funeral service itself, as the Hindu, Sikh and Muslim religions do, where the family is required to wash and dress the deceased at the funeral facilities. Other faiths require nightly vigils or even the funeral to be held within a certain period of time, usually no more than 24 hours after the death.

Despite the increasing secularisation of burials, British funeral companies are aware of the influence that religious leaders still have. In many cases, congregations recommend that their members use a specific service provider, they are also in charge of collecting funds to finance funerals, or they even celebrate funerals in their own facilities. Most mosques are provided with rooms, a morgue and a reputable funeral home that handles the process, and many synagogues have hired a company to offer their members a standard package for a fixed fee.

Rates and funeral services under consideration in the UK funeral industry

According to the UK Funeral Market Report published at the end of 2020 by the UK Competition and Markets Authority (CMA), the UK funeral industry is sub-optimal in a number of key respects. These include the difficulty for customers to access several competitors as well as disproportionate price growth, due to lack of both information and knowledge of families when contracting funeral services.

The British market will therefore have to respond to different recommendations that will be implemented once the magnitude of the impact of the Covid-19 on the funeral sector in the country has been analysed.