Table of Contents

The excess mortality has led to an exceptional demand for many companies, which have been unexpectedly forced to increase their costs in terms of staff, logistics and infrastructures. The funeral market forecast predicts an economic recession in 2021, which will undoubtedly affect the growth of the service sector too.

The funeral industry in the world: factors to be taken into account

The death care industry is experiencing unusual economic developments due to the exceptional increase in mortality caused by the coronavirus pandemic. The demand for funeral services during 2020 has soared to the point of near-collapse of the funeral sector in many countries. Suppliers were overwhelmed by an unprecedented situation in recent history and many countries such as Spain and the United Kingdom had to install emergency morgues, or even use refrigerator trucks as makeshift warehouses in the case of the United States.

According to the figures published by the Ministry of Health, in December Mexico exceeded 109,000 deaths from coronavirus. Despite the increase in mortality, the president of the Association of Funeral Home Owners and Embalmers of Mexico City, David Vélez, assured that they did not suffer saturation in the death certificate delivery services nor in the crematoria during the second wave. The reason is that “they increased the number of cremations, but they also extended the schedules” to offer almost immediate attention to the deceased, as Vélez explained in an interview published by Milenio2020.

In Germany, with about 18,000 deaths from coronavirus at the end of 2020, funeral homes have also opted to extend their opening hours to reduce the waiting time for families. In Geneva, Switzerland, where the number of deaths of people over 65 during the second wave almost doubled, they averaged 18 cremations a day, according to data published by Swiss television SRF.

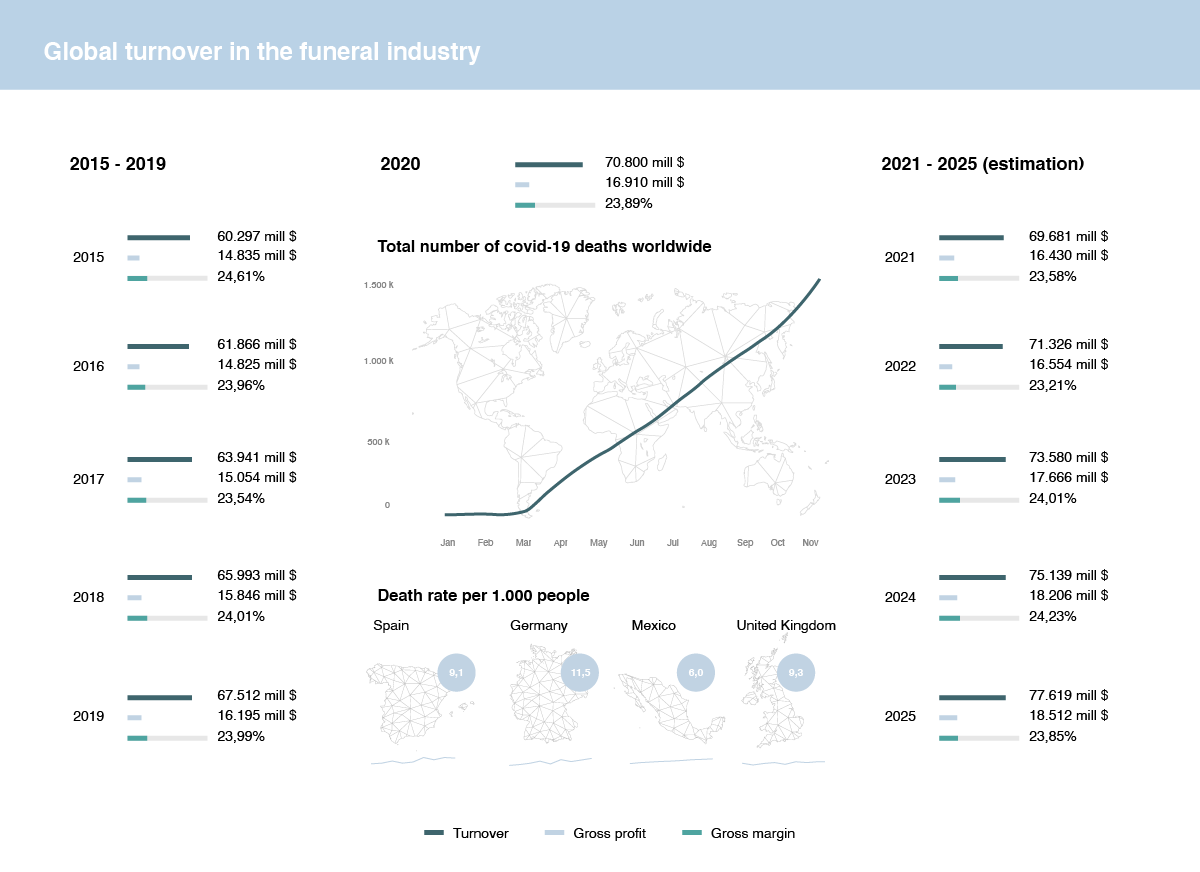

At an international level, it is estimated that the total value of the funeral market has exceeded 70.8 billion dollars during 2020, with an increase of 3,288 million dollars over the previous year. The market is expected to increase its gross profit to 16,910 million dollars (715.4 million more than the previous year). However, the gross margin stands at 23.89%, a tenth lower than the figures recorded in 2019, due to the increase in costs associated with the covid-19.

A quick reaction to the pandemic

The increase in demand is generally positive for any business, unless this increase exceeds all forecasts and forces companies to take on a series of unexpected expenses that destroy the balance between cost and profit. And this is precisely what has happened in the Spanish funeral industry.

At the height of the pandemic, the increase in demand for funeral services reached over 400% with respect to the same period in previous years, according to the Daily Mortality Monitoring System (MoMo), which compares the average mortality observed in the last ten years with the mortality reported by the civil registries of the Ministry of Justice.

At the height of the pandemic, the increase in demand for funeral services reached over 400% with respect to the same period in previous years.

The lack of stock and staff forced the main funeral companies to react quickly in order to meet all the requests. Overtime was increased and staffing levels rose by an average of 10%, reaching 33% in the most serious cases.

Like other companies, funeral service providers have had to adapt to new laws against the spread of coronavirus. In the course of 2020, rooms have been closed, ceremonies have been banned and seating has been drastically reduced. There has also been a need to purchase personal protective equipment, more cleaning materials and specific shrouds, with the resulting expense.

Market evolution in the funeral industry in recent years

The funeral market depends directly on the mortality rate. It is therefore a sector with an established and relatively constant demand, except in exceptional cases such as that caused by the pandemic.

In recent years the death rate has been on an upward trend in many European countries, Japan and the United States. This is because medical advances have led to a general decline in deaths, but the plummeting birth rate has resulted in a progressive ageing of the population.

Similarly, average household incomes have risen to levels close to those before the economic crisis of 2008. This increase in household income has fuelled the growth of the funeral industry, which has recorded a 14% rise in global turnover over the past five years.

One of the fastest growing industries

In 2015, funeral service companies made a gross profit of $14,835.8 million with a gross margin of 24.61%. In the last five years, the value of the industry has grown by 17.4% and its gross revenues have increased by 14% with a nine-tenths decrease in the gross margin.

Innovation in the funeral industry

Another key to the growth of the funeral industry in the last five years is the innovation adopted by funeral directors, crematoria and cemeteries. In recent decades, funeral services have been marked by religious tradition, but the industry has begun to adapt to new trends and companies are already offering original and innovative farewells.

These initiatives include forest cemeteries that replace graves with trees, live transmission of the ceremony, legal and logistical advice or ecological funerals with biodegradable coffins integrating the Sustainable Development Goals of the United Nations. The companies seek to offer a range of services as diverse as their own clients and in this way, be able to differentiate themselves from the rest of the companies in an increasingly competitive industry.

Funeral market forecast for 2025

Covid-19 has had a huge impact worldwide and has caused severe economic recessions in many countries. According to World Bank projections, the world’s gross domestic product is expected to shrink by 5.2% by 2020, the deepest global recession in decades. This implies that per capita incomes in most emerging and developing economies will shrink.

The most optimistic forecasts estimate that with the long-awaited arrival of the advanced vaccine by companies such as Moderna, Pfizer and Oxford, further confinement will be avoided and the cessation of non-essential activity will be avoided, as has happened in many countries over the past year. This will enable a relatively quick recovery in the most developed economies.

It’s expected that gross profit growth will exceed $18.512 billion in 2025.

With regard to the funeral market forecast, it is estimated that during this year gross income will fall by 1.6% worldwide. However, taking the progressive ageing of the population and the maintenance of the mortality rate into account, the market forecast points, once again, to a progressive increase in turnover figures from 2022 onwards. According to figures from Maia Research, gross profit growth will exceed $18.512 billion in 2025, up 12.6% from the previous four years.